All Categories

Featured

Table of Contents

- – Trusted Investment Platforms For Accredited In...

- – Innovative High Yield Investment Opportunities...

- – Tailored Top Investment Platforms For Accredi...

- – Top-Rated Accredited Investor Investment Fund...

- – Value Private Placements For Accredited Inve...

- – Trusted Investment Platforms For Accredited ...

- – Premium Accredited Investor Growth Opportuni...

The laws for accredited investors vary among territories. In the U.S, the definition of a recognized financier is presented by the SEC in Regulation 501 of Guideline D. To be a recognized capitalist, an individual should have an annual earnings exceeding $200,000 ($300,000 for joint income) for the last two years with the assumption of gaining the same or a greater earnings in the existing year.

A certified capitalist needs to have a total assets surpassing $1 million, either individually or collectively with a spouse. This amount can not include a main residence. The SEC likewise takes into consideration candidates to be recognized investors if they are general partners, executive officers, or supervisors of a company that is providing non listed safety and securities.

Trusted Investment Platforms For Accredited Investors for Secured Investments

If an entity consists of equity proprietors that are certified investors, the entity itself is a certified financier. Nonetheless, a company can not be created with the sole purpose of buying particular protections - accredited investor passive income programs. A person can certify as a certified investor by demonstrating enough education and learning or task experience in the financial market

Individuals that intend to be accredited capitalists do not put on the SEC for the classification. Instead, it is the obligation of the firm offering a private positioning to see to it that all of those approached are approved investors. People or events that wish to be approved financiers can approach the issuer of the unregistered securities.

Expect there is a specific whose income was $150,000 for the last 3 years. They reported a key house worth of $1 million (with a mortgage of $200,000), an automobile worth $100,000 (with a superior loan of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

Internet well worth is determined as properties minus liabilities. He or she's internet well worth is specifically $1 million. This involves an estimation of their possessions (aside from their primary residence) of $1,050,000 ($100,000 + $500,000 + $450,000) much less a vehicle loan equaling $50,000. Considering that they satisfy the total assets requirement, they qualify to be an accredited investor.

Innovative High Yield Investment Opportunities For Accredited Investors for Exclusive Opportunities

There are a couple of less common certifications, such as handling a count on with more than $5 million in assets. Under government securities legislations, just those who are certified investors might take part in particular safeties offerings. These might consist of shares in personal positionings, structured products, and private equity or hedge funds, among others.

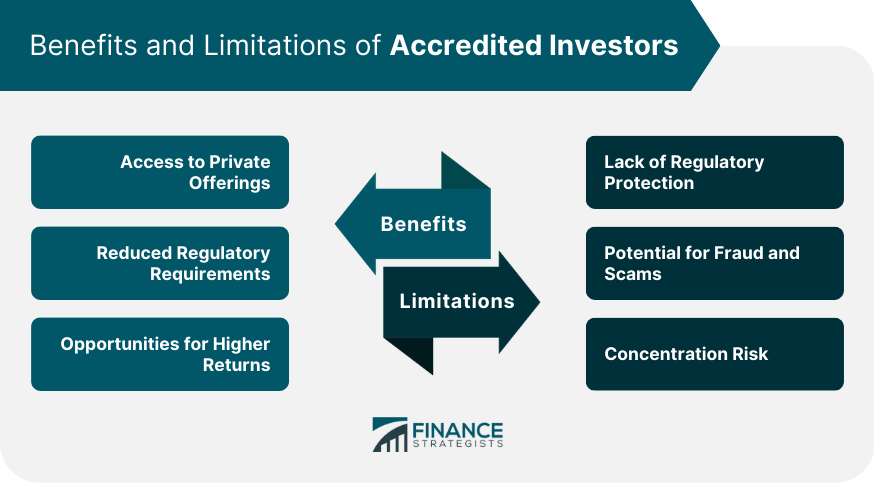

The regulators intend to be certain that participants in these very high-risk and intricate investments can look after themselves and evaluate the dangers in the lack of federal government defense. The certified investor regulations are developed to shield potential financiers with restricted monetary expertise from adventures and losses they might be unwell furnished to hold up against.

Recognized financiers fulfill credentials and specialist standards to accessibility unique financial investment possibilities. Designated by the United State Securities and Exchange Commission (SEC), they gain entry to high-return choices such as hedge funds, endeavor resources, and exclusive equity. These financial investments bypass full SEC enrollment but carry higher risks. Approved investors should satisfy income and total assets needs, unlike non-accredited individuals, and can invest without limitations.

Tailored Top Investment Platforms For Accredited Investors

Some essential modifications made in 2020 by the SEC include:. This change identifies that these entity kinds are often utilized for making financial investments.

These modifications expand the accredited financier pool by roughly 64 million Americans. This broader accessibility provides a lot more opportunities for investors, yet additionally boosts potential threats as much less economically sophisticated, financiers can get involved.

These investment choices are exclusive to recognized capitalists and establishments that certify as a recognized, per SEC guidelines. This gives accredited investors the possibility to invest in arising business at a phase prior to they consider going public.

Top-Rated Accredited Investor Investment Funds for Accredited Investor Platforms

They are considered as investments and are accessible only, to certified customers. Along with well-known companies, qualified investors can pick to buy startups and promising endeavors. This offers them income tax return and the opportunity to enter at an earlier stage and potentially reap benefits if the business thrives.

For investors open to the dangers involved, backing startups can lead to gains (exclusive investment platforms for accredited investors). Many of today's technology companies such as Facebook, Uber and Airbnb originated as early-stage startups sustained by recognized angel investors. Advanced financiers have the chance to explore financial investment alternatives that may yield a lot more earnings than what public markets supply

Value Private Placements For Accredited Investors

Returns are not ensured, diversity and profile improvement alternatives are broadened for investors. By expanding their portfolios via these increased financial investment opportunities approved investors can boost their methods and potentially attain exceptional long-term returns with proper danger administration. Seasoned financiers frequently encounter investment choices that might not be conveniently readily available to the general financier.

Investment alternatives and securities used to recognized capitalists typically involve higher dangers. For instance, private equity, equity capital and hedge funds often concentrate on purchasing possessions that lug danger but can be sold off quickly for the opportunity of higher returns on those risky investments. Looking into prior to spending is important these in scenarios.

Secure periods stop investors from taking out funds for even more months and years on end. There is likewise far much less transparency and governing oversight of exclusive funds contrasted to public markets. Financiers might battle to properly value private properties. When handling threats accredited capitalists need to assess any kind of private financial investments and the fund managers involved.

Trusted Investment Platforms For Accredited Investors for Secured Investments

This modification may extend recognized capitalist status to an array of individuals. Permitting partners in committed relationships to integrate their sources for shared qualification as accredited capitalists.

Making it possible for people with certain professional certifications, such as Collection 7 or CFA, to qualify as accredited financiers. This would certainly identify economic sophistication. Creating extra needs such as proof of economic literacy or effectively completing a recognized financier exam. This might guarantee capitalists recognize the risks. Restricting or getting rid of the key home from the internet worth calculation to reduce possibly inflated assessments of wealth.

On the various other hand, it could also result in seasoned capitalists presuming excessive risks that might not appropriate for them. Safeguards might be required. Existing recognized investors may deal with enhanced competitors for the very best financial investment possibilities if the pool expands. Firms raising funds may benefit from a broadened recognized financier base to attract from.

Premium Accredited Investor Growth Opportunities for Wealth-Building Solutions

Those that are presently taken into consideration certified financiers need to remain updated on any alterations to the requirements and regulations. Their eligibility may be based on adjustments in the future. To keep their standing as certified investors under a changed meaning modifications may be needed in wide range administration techniques. Organizations seeking accredited financiers should remain watchful regarding these updates to guarantee they are attracting the right audience of financiers.

Table of Contents

- – Trusted Investment Platforms For Accredited In...

- – Innovative High Yield Investment Opportunities...

- – Tailored Top Investment Platforms For Accredi...

- – Top-Rated Accredited Investor Investment Fund...

- – Value Private Placements For Accredited Inve...

- – Trusted Investment Platforms For Accredited ...

- – Premium Accredited Investor Growth Opportuni...

Latest Posts

How To Find Properties That Owe Back Taxes

Investing In Secured Tax Lien Certificates

Houses Sold For Taxes

More

Latest Posts

How To Find Properties That Owe Back Taxes

Investing In Secured Tax Lien Certificates

Houses Sold For Taxes